Are you tired of living paycheck to paycheck and feeling like your debt is holding you back from achieving your financial goals? You’re not alone. In this blog, we’ll explore the top 5 methods to pay off debt that can help you take control of your finances and get on the path to a brighter future.

Millions of people struggle with debt, but the good news is that there are effective strategies you can use to pay it off and achieve financial freedom.

Whether you’re dealing with credit card debt, student loans, or other types of debt, these strategies can help you pay it off faster and start building a more secure financial future.

Why Should You Pay Off Debt Quickly?

There are so many reasons why you may want to pay off debt. Some of them include:

Save Money On Interest

When you have debt, you’re also paying interest on that debt. The longer you take to pay it off, the more you’ll end up paying in interest. By paying off debt as quickly as possible, you can save money on interest in the long run.

Improve Your Credit Score

Your credit score is based, in part, on your credit utilization ratio, which is the amount of credit you’re using compared to your available credit. If you have a lot of debt, your credit utilization ratio will be high, which can lower your credit score.

By paying off debt, you can lower your credit utilization ratio and improve your credit score. And the higher your credit score, the lower your interest rate will be when taking on more debt. This can be especially important when taking on large dollar debt like a mortgage.

Reduce Stress

Debt can be a major source of stress and anxiety. It can even cause physical health problems like impaired cognitive function in some people. By paying off debt, you can reduce the financial burden and feel more in control of your finances.

Pay Off Debt to Achieve Financial Freedom

When you’re in debt, your money is tied up in payments to creditors. By paying off debt, you can free up that money to use towards other financial goals, such as saving for retirement, buying a home, or starting a business. Although you should still try to save and invest while paying off debt, especially if you have any employer matching.

How To Get Started With Your Debt Pay Off Plan:

Getting started with a debt pay off plan can be overwhelming, but with a few simple steps, you can create a plan that works for you. Here are some steps to help you get started:

Assess Your Debt

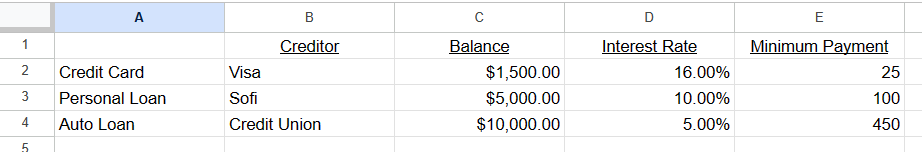

Make a list of all your debts, including the creditor, balance, interest rate, and minimum payment.

Prioritize Your Debts

Rank your debts in order of highest interest rate to lowest interest rate. This will help you determine which debt to pay off first depending on the strategy you choose.

Set A Budget

Create a budget that includes all your income and expenses. This will help you identify areas where you can cut back and allocate more money towards debt repayment. Check out my FREE Budget Blueprint to help get started!

Determine Your Debt Pay Off Strategy

There are 5 main strategies for debt repayment: the snowball method, the avalanche method, debt consolidation, balance transfer, and debt settlement. It’s important to choose a strategy that works best for your financial situation and goals. We cover these 5 strategies in detail below with examples!

Here are 5 strategies you can use to pay off debt:

1. Snowball Method

This strategy involves paying off your smallest debt first, then moving on to the next smallest, and so on. You make the minimum payments on all your debts except for the smallest one, which you pay as much as you can until it’s fully paid off. Once that’s done, you move on to the next smallest debt, and so on. This method can be motivating because you get the satisfaction of crossing debts off your list.

Example: Let’s say you have three debts: a credit card with a balance of $1,500, a personal loan with a balance of $5,000, and a car loan with a balance of $10,000.

With the snowball method, you would focus on paying off the credit card first, putting all your extra money towards it until it’s paid off. Then, you would move on to the personal loan, using the money you were putting towards the credit card to pay it off faster. Finally, you would pay off the car loan, using the money you were putting towards the credit card and personal loan to pay it off faster.

2. Avalanche Method – My Favorite =)

With this strategy, you prioritize debts with the highest interest rates. You make the minimum payments on all your debts, but put extra money towards the debt with the highest interest rate until it’s paid off. Then you move on to the next highest interest rate debt, and so on. This method is my FAVORITE because it can save you money on interest over the long run.

Example: Let’s use the same example as above, but this time we’ll use the avalanche method. With this method, you would focus on paying off the debt with the highest interest rate first, which in this case would be the credit card. Once that’s paid off, you would move on to the personal loan, and finally, the car loan.

3. Debt Consolidation

This strategy involves combining all your debts into one loan with a lower interest rate. This can make it easier to manage your debt and potentially save you money on interest. You can do this by getting a personal loan, transferring balances to a credit card with a lower interest rate, or using a debt consolidation service.

Example: Let’s say you have multiple credit cards with high-interest rates and you’re struggling to keep up with the payments. You could look into debt consolidation and take out a personal loan with a lower interest rate to pay off all of the credit card balances. This would simplify your payments and could save you money on interest over time.

4. Balance Transfer

This strategy involves transferring high-interest credit card debt to a card with a 0% or low-interest promotional rate. This can save you money on interest, but be sure to pay off the balance before the promotional rate ends, or you could end up with even more debt.

Example: Similar to the example above, let’s say you have a credit card with a high-interest rate and a balance of $5,000. You could transfer the balance to a credit card with a lower interest rate, which could save you money on interest charges.

5. Debt Settlement

This strategy involves negotiating with your creditors to settle your debts for less than what you owe. This can be a risky strategy because it can hurt your credit score, and you may end up owing taxes on the forgiven amount.

Example: Let’s say you have a debt with a collection agency that has been sold for $5,000, but you’re having trouble paying it off. You could try to negotiate with the collection agency to settle the debt for less than what is owed. In this example, you might be able to settle the debt for $3,500 and save $1,500. However, debt settlement can have a negative impact on your credit score and should be considered a last resort.

Start Paying Off Your Debts

Once you have determined your repayment strategy, start making extra payments towards your debts. Be sure to continue making at least the minimum payments on all your debts to avoid penalties.

Track Your Progress

Monitor your progress regularly and adjust your plan as needed. Celebrate small wins along the way to stay motivated. You can have a small amount set aside as part of your budget plan to reward yourself every time you reach a milestone.

Remember, getting out of debt takes time and effort, but it is possible with a solid plan and consistent effort.

A Final Word on Debt Pay Off for Financial Freedom:

While paying off debt is an important step towards financial freedom, it’s not the only way to achieve it. In fact, there are several other strategies you can use to achieve financial freedom that don’t necessarily involve paying off debt as quickly as possible.

One of the most important strategies is to focus on increasing your income. This can be done by asking for a raise at work, starting a side business or freelancing, investing in the stock market or real estate, or taking on part-time work. By increasing your income, you’ll have more money to put towards achieving your financial goals.

Another important strategy is to focus on building your savings and investments. Saving for an emergency fund can help you avoid taking on more debt when unexpected expenses arise, and can give you peace of mind knowing you have a financial safety net.

Additionally, saving for retirement is an important part of achieving financial freedom, as it allows you to live comfortably in your later years without worrying about financial insecurity.

Finally, it’s important to create a budget and stick to it. A budget can help you manage your expenses and ensure you’re living within your means. It can also help you identify areas where you can cut back on spending, which can free up more money to put towards achieving your financial goals.

Conclusion

While paying off debt is certainly a part of achieving financial freedom, it’s important to remember that it’s not the only way.

Many types of fixed rate debt like auto, student, and home loans already have a fixed term so they will be paid off with regular payments anyways. If the interest rates on those loans are low or below 7-8% AND you focus on investing your additional income in assets (like stocks or real estate) that could return 10-15%, then there is no shame in making your minimum payments.

By focusing on increasing your income, building your savings, and creating a budget, you can achieve financial freedom and enjoy a more secure and fulfilling financial future.

What are your debt pay off goals? Let me know in the comments!